The booming used vehicle market

The used vehicle market is by far the biggest automobile market in France

5 398 335

second-hand cars, sold in 2024

+ 2,9%

This result comes close to the very high figure recorded in 2019 before the pandemic (5,790,611 cars).

Since then, the market has remained resilient, unlike the new car market, which is currently struggling to exceed 1.7 million units (1,718,449 new cars registered in 2024).

The used car market should therefore be seen as the true reflection of the vitality of the current car fleet, which is growing (42,221,000 cars) and ageing (average age 11.9 years) at the same time.

Professionals win market share as prices rise

It should also be noted that professionals have only a minority share of second-hand sales in France:

The share held by professionals has risen sharply over the last ten years, as motorists’ needs for reassurance and services have increased sharply (traceability, warranties, combating second-hand fraud)

Average selling prices for used vehicles have also risen, remunerating this increase in the quality of the vehicles sold. Parts and labour warranties have also increased, either through the promises of manufacturers’ labels (Spoticar, Toyota Occasions, Renault Renew), or through warranties offered by sellers, either directly or via warranty providers (warranty booklets).

Used vehicle professionals, a substantial business reservoir

Used vehicle sales in France

There are seven families of used vehicle sales channels:

– Car distribution groups (groupe Autosphère-Emil Frey, Cosmobilis, ChopAutosphère-Emil Frey group, Cosmobilis, Chopard, Bodemer, Clara Automobiles, Gemy, etc.);

– Used vehicle dealers for end customers and/or professionals (Starterre, VPN-Groupe SIPA, Saint-Herblain Automobiles-Distinxion-ZéroKM, Aramis, SN Diffusion, etc.);

– Very small businesses, such as manufacturer dealers or all-makes garages;

– Auction companies are fast-growing players: most of them operate ‘mixed’ auctions, for private and professional customers (Alcopa, Enchères VO-groupe Arnauné, VP Auto), while some specialise only in professional trader customers (BC Auto Enchères).

There are also three channels for sales to professionals:

– Manufacturers’ used car spinoffs (such as Renault VO; Spoticar Trade by Stellantis);

– Used car remarketing platforms run by car leasing companies (such as Arval Motortrade or ALD Car Market);

– Used car sales by some car rental companies (such as Hertz or Europcar), for the proportion of their fleet that they own.

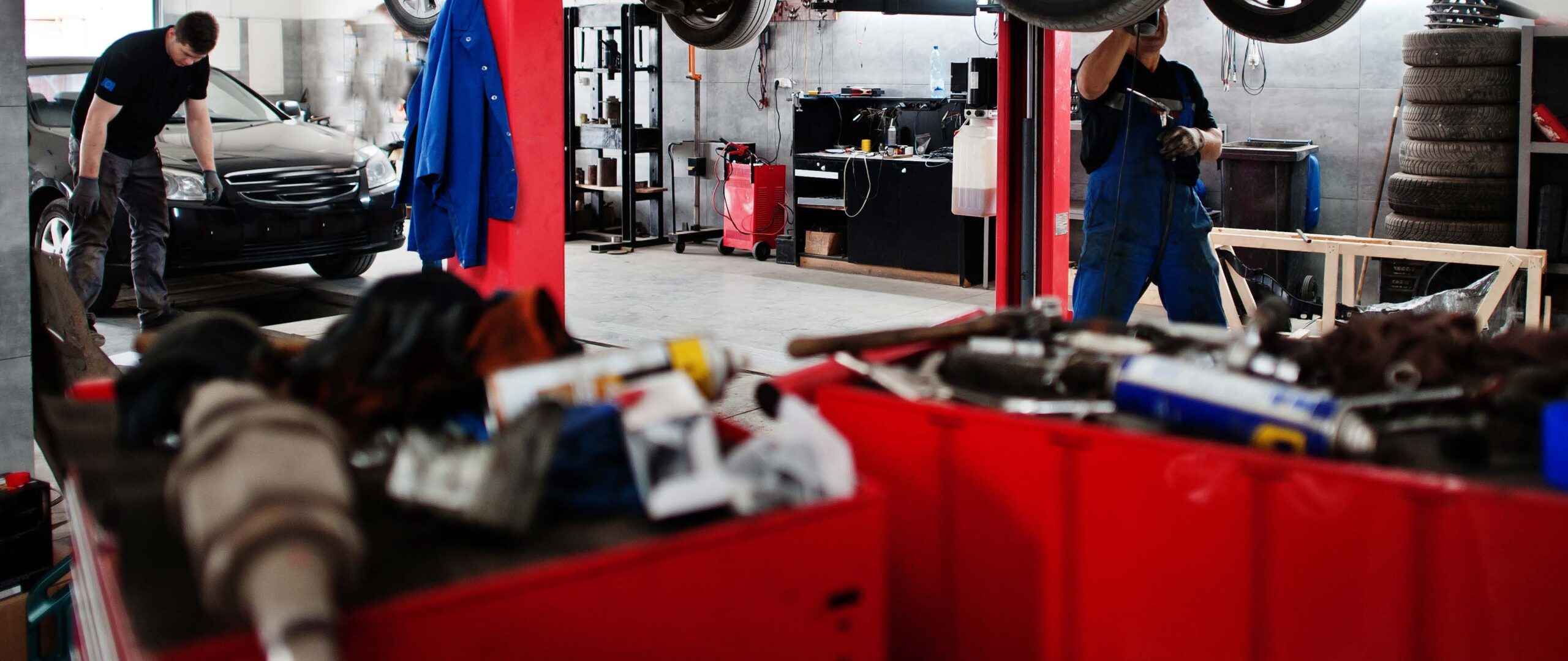

Used vehicle reconditioning, an activity in its own right

With car reliability increasing over time, but also with average selling prices rising, the expected margin levels are now conditional on substantial reconditioning work.

The ‘ready-to-drive used car’ business has become a real market trend.

€ 720*

excluding VAT average cost of reconditioning a used car

* Source : L’argus 2024

THE USED CAR RECONDITIONING BUSINESS WORTH:

€ 1,7

billion excluding VAT

44%

of cars sold by professionals or 2,376,000 cars

This turnover, however, should be interpreted as intra-company, with lower hourly labour rates and parts margins than those for end customers. Many suppliers deal in equipment and methods for the cosmetic refurbishment of used vehicles (smart repair); mechanical refurbishment most often involves buying parts from equipment manufacturers competing with original equipment brands or chain brands, or even remanufactured parts, which are becoming a significant component of the used vehicle preparation business.

An ecosystem represented in depth at EQUIP AUTO Paris

EQUIP AUTO Paris 2025 will bring together the entire used car market ecosystem within Univers VO, the village dedicated to all the service providers involved in the used car business. These include:

- used-vehicle management software publishers (such as PVO² from L’argus-leboncoingroupe);

- classified ad specialists (online infomediaries);

- vendors of photo and video solutions before ad publication;

- equipment for automated estimates of reconditioning costs (e.g. Tchek; Proovstation);

- used vehicle trade-in and sourcing specialists (auctioneers, used vehicle dealers, etc.).

Circular economy:

reusable parts, remanufacturing, recycling

The circular economy has gone mainstream

In collision repair, reusable parts, encouraged by insurers and the loss adjuster community, are experiencing strong growth. In mechanical engineering and electronics, remanufacturing is also booming, driven by new product ranges.

EQUIP AUTO Paris 2025 will be giving prominence to this sector in the Circular Economy Village.

Reusable parts constitue anever-crowing offering, or ‘ressource pool’

€+500

million excluding VAT of turnover

They are increasingly in demand in the collision repair market

15,6% *

of loss adjuster reports validating repairs listed at least one reusable part in 2023. Reusable parts are also bought by used vehicle professionals to reduce the cost of reconditioning before resale.

* Source : Sécurité et Réparation Automobile (SRA)

The reusable parts category encompasses

second hand parts,

salvaged by recyclers by dismantling end-of-life vehicles (ELV) and sold on in the same condition by authorised treatment facilities.

remanufactured parts,

which are either ‘like for like’ parts (i.e. parts refurbished to brand new condition by specialist workshops working to manufacturer specifications), or reconditioned parts, which are second hand parts that have been checked and approved by a professional.

parts repaired to order

by specialist professionals. This could apply for example to electronic components, or parts for vintage vehicles that have become hard to find on the market.

First held at EQUIP AUTO Paris 2022, the Circular Economy Village will be one of the big crowd pullers at EQUIP AUTO Paris 2025. This Village places the circular economy at the heart of the show. This space provides a unique opportunity for industry players to showcase their ranges, expertise and know-how. These will include remanufacturers, vehicle

recyclers, distributors of reusable parts and dedicated service companies.

Mobilians Remanufacturing was created at the beginning of 2024 when the France Auto Reman association joined Mobilians to become the 21st business line, within the

Circular Economy cluster. It is chaired by Julien Dubois, the founder of France Auto Reman, and has a remit to promote remanufacturing activities on behalf of its remanufacture members. Mobilians Remanufacturing will be exhibiting in the Circular Economy Village at EQUIP AUTO Paris 2025.

Automotive recycling is an essential part of the circular economy

Recycling is defined as the combination of actions to identify, collect, depollute, deconstruct, sort, reuse and finally recover automotive components and materials.

Under the 2020 AGEC (Anti Gaspillage pour une Economie Circulaire) Act, Extended Producer Responsibility (EPR) was extended to car manufacturers in 2023. They are now obliged to choose either a collective system, known as an ‘eco-organisation’, or an individual system, to finance and administer the disposal of end-of-life vehicles under their responsibility. Renault, Stellantis and Groupe Volkswagen France have opted for an individual system, while importers have chosen to collectively join the eco-organisation recyclermonvehicule.fr to manage the traceability of their end-oflife vehicles’ disposal.

* Source: Ademe report, the French Environment and Energy Agency (2021)

Used vehicles, Reusable parts, Remanufacturing, Recycling

2.61 MoDownload