Source : Gipa France

Mechanical maintenance

€15.8 billion (excluding VAT)

This sales figure is rising steadily each year, mainly due to technological developments in replacement components.

The market’s value has risen by 23% since 2014, only slightly above inflation (+22.1% over ten years, source: Insee), implying that prices are being regulated by fierce competition between players.

The collision repair market

€5 billion (excluding VAT)

of which 3.25 billion euros are for bodywork collision repair and just over 1.7 billion for the auto glass market.

Sources: SRA, insurers

€+5 billion (excluding VAT)

for expenditure on warranties and maintenance contracts; accessories (e.g. multimedia fittings post-purchase), car washes (1 billion euros), roadworthiness tests.

Sources: Gipa France

The total aftermarket, comprising cars and commercial vehicles, thus amounts to €32 billion excl. VAT.

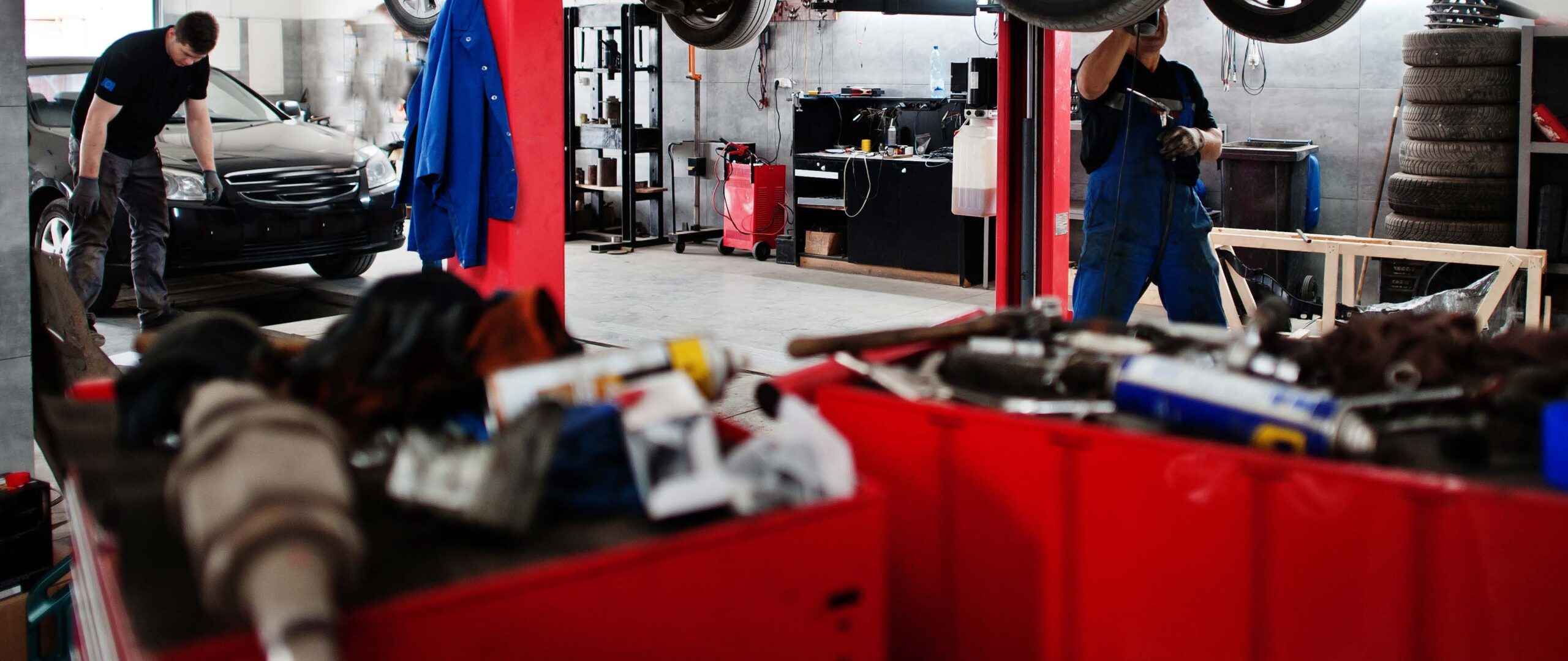

A higher share held by the all-makes aftermarket

Mechanical aftermarket sales break down(in turnover).

In terms of volume, the balance of the market has been steadily shifting towards of multi-make market players (IAM, standing for the independent aftermarket) since 2016.

In 2023, the IAM accounted for

71%

of total workshop admissions vs 29%* for manufacturer networks*

*OES, Original Equipment Sales, carmaker dealers and showrooms

The independent aftermarket is currently led by the independent businesses operating under a brand name or in their own name. These account for:

34%

of vehicle admissions, ahead

AUTO CENTRES

30%

of workshop admissions

The digital transformation: driving online sales and changing the customer relationship

The digital revolution has been ongoing for around ten years, and has changed the way the automotive aftermarket operates.

45%

of drivers used the internet for aftermarket services in 2023

Whether to book an appointment online, get information or make a purchase, almost half of all motorists now go online before they go to the garage. This generational phenomenon can only be expected to increase in the future.

There are four main criteria for choosing a garage:

- the reliability of the repairer (measured in particular by customer reviews),

- proximity,

- customer service/welcome,

- price.

Price is therefore only the fourth most important factor for customers. The notion of repairer reliability is invariably linked to reputation and, in particular, e-reputation.

The automotive parc can only get older

The on-the-road car fleet in France is growing and getting older.

41 626 221

cars

+1%

2022/2023 data as of Januray 2024

source : AAA Data

THE AVERAGE AGE OF FLEET IN 2024

11,9 ans

+2,6% vs 2022 (11,6 year)

SIGNIFICANT REGIONAL VARIATIONS

- 13,6 years in Creuse

- 9,7 years in Paris

- 8,8 years in French Guiana

2024 did not buck the trend, as the new car market remained sluggish.

NUMBER OF REGISTRATIONS IN 2024

1 718 449

new cars

-3,2% vs 2023

Source : NGC-Data d’après SIV

4,1%

of the total volume of the vehicle fleet which offers evidence of a low vehicle replacement rate

At this pace, and given the much lower volume of cars being sent to the scrapyard (around 1.5 million end-of-life vehicles set to authorised treatment facilities during the year) the fleet can only continue to age.

DIY is still thriving

Ten years ago, many market observers thought that do-it-yourself (DIY) repairs were doomed to disappear as car technology evolved. But that was without taking into account the ageing of the fleet, as documented above, and the total cost of owning a car.

The French are paying increasingly close attention to all cost factors. Upkeep is no exception:

38%

of motorists did at least one car maintenance operation themselves

(pure DIY, DIY with help or Buy-and-Fit)

Source : GIPA France in 2023

Even excluding the simplest operations (e.g. changing a windscreen wiper blade or topping up fluids), this figure still stands at 21% of motorists. So DIY repair is by no means over the hill.

The automotive aftermarket

982.29 KoDownload